Iran Braces for Trump Reset With Economy Buckling From Sanctions

When Donald Trump first entered the White House in 2017, Cyrus Razzaghi was running an Iranian business consultancy, advising US, Japanese and European companies about how to grab opportunities in a market emerging from years of economic isolation.

That all changed the following year, when the then-US President abandoned Iran’s landmark nuclear deal with world powers and imposed severe economic sanctions instead.

“We had to diversify away from Iran and somehow hedge ourselves for further animosity,” Razzaghi, chairman of Ara Enterprise Consultancy Group, said by phone from Tehran. “At one point we thought there was going to be a war.”

As Trump prepares for a second term as US president, all eyes are on whether he will revive his so-called maximum pressure policy against Iran that came to mark his first spell. But with Iranians struggling with economic hardship after years of sanctions, its leaders are signaling they’re keen to establish a different relationship this time around.

On Tuesday, the United Nations nuclear watchdog said Iran had agreed to stop producing uranium enriched to levels near those required for making bombs — an unprecedented move seen by some as an olive branch to Trump. New Iranian President Masoud Pezeshkian, a straight-talking reformist, has prioritized sanctions relief, rapprochement with the West and economic “normality” for Iranians since his surprise election win in July.

“We are very worried and concerned about Trump’s return, though I wouldn’t rule out a deal with Trump either,” Razzaghi said.

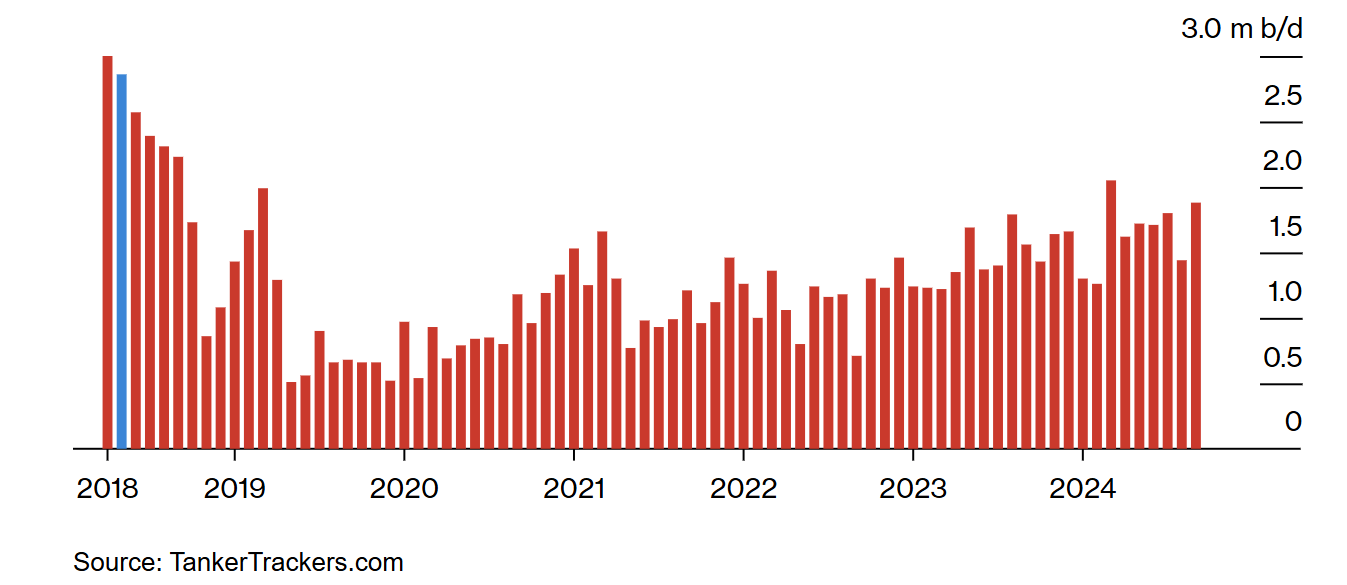

Oil Trade

A hardline approach by Trump could significantly impact Iran’s oil trade, with the President-Elect having squeezed flows from the Islamic Republic during his first term that ended in 2021.

“On top of the sanction list will be Iranian crude oil exports,” said John Evans, an analyst at brokers PVM Oil Associates Ltd. in London. “The playbook will be similar to the one experienced during the first Trump presidency.”

Iran’s Oil Exports Have Risen Since 2020

But they could slump if Trump reapplies his `maximum pressure’ strategy

Like other producers, Tehran is contending with a 15% slide in crude prices since late June and the prospect that an impending global glut will trigger a further slump next year. Iranian oil output has recovered considerably in recent years, as refiners in China — Tehran’s biggest customer — snap up cut-price barrels and the Biden administration eases enforcement of sanctions to rein in gasoline costs.

Like other producers, Tehran is contending with a 15% slide in crude prices since late June and the prospect that an impending global glut will trigger a further slump next year. Iranian oil output has recovered considerably in recent years, as refiners in China — Tehran’s biggest customer — snap up cut-price barrels and the Biden administration eases enforcement of sanctions to rein in gasoline costs.

It’s unclear if the recovery could prove resilient against another Trump term, even with the formidable logistical network the Islamic Republic has built up to circumvent sanctions.

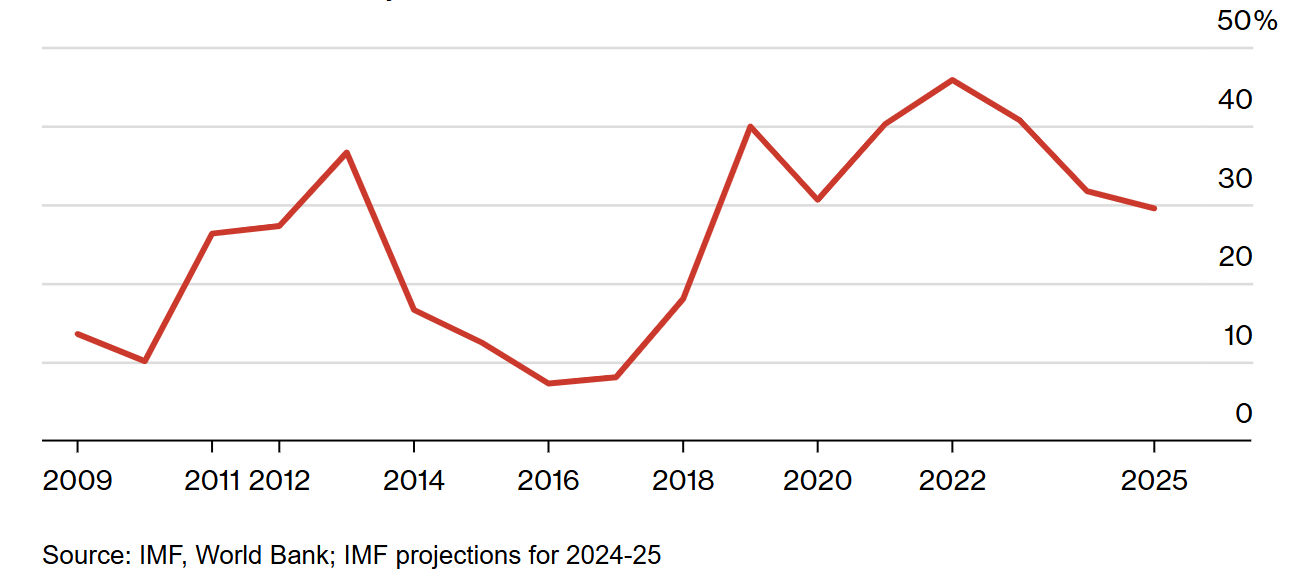

Economic Hardship

In Iran, Pezeshkian faces myriad economic challenges, including inflation of more than 30%, fuel shortages, high capital outflows and the loss of skilled and educated workers through migration to Europe and the US. The rial has tanked to successive record lows against the dollar and has so far lost more than 90% of its value since May 2018.

“Reducing tension with the US is essential for Iran’s economic stability,” said Maciej Wojtal, chief investment officer at Amtelon Capital. “The new government has sent clear messages, indicating a willingness to negotiate – a shift from its usual strategy of escalating uranium enrichment as leverage.” Wojtal said.

Inflation in Iran Remains Above 30%

Rapid prices rises have helped cause unrest in the Islamic Republic

Wrangling over Iran’s atomic activities remains a factor however, with Tehran saying Friday it will increase the number of centrifuges in its nuclear program in response to a censure by the United Nations’ watchdog — even as it commits to stop producing weapon-ready uranium.

Blackouts, Protests

The lack of critical investment needed for Iranian infrastructure has forced Tehran to increase imports of high-quality gasoline as its own refineries struggle to keep up, while introducing rolling electricity blackouts as power stations struggle to supply homes and industry.

All of this points to even higher inflation, which Pezeshkian can ill afford at a time of regional conflict and instability — abroad and at home. Iran was hit by deadly protests in 2019, triggered by a rise in gasoline prices, and a national uprising three years later, the biggest popular rebuke against Supreme Leader Ayatollah Ali Khamenei and the country’s system of religious rule since 1979.

“Pezeshkian’s job is to bring about national reconciliation and he’s been somewhat successful,” said Vali Nasr, a former senior advisor to the US State Department and a professor at Johns Hopkins University.

Pragmatic Team

Pezeshkian has appointed a foreign-policy team led by Abbas Araghchi that not only negotiated the original nuclear agreement in 2015 but had to deal with the chaos unleashed after Trump walked away.

Their presence “shows the Iranians are definitely interested in a deal with the US,” Nasr said. “They are pragmatic enough to know that if they find a way forward, it’s much better to deal with someone who can get a deal done.”

It’s unclear how Trump’s new government will respond to Iranian pragmatism. His cabinet nominations so far include staunch allies of Israel — which which the Islamic Republic has exchanged direct fire twice this year — and people who have advocated bombing Iran.

Iran’s challenge is that it “needs a direct channel to Trump to overcome the resistance of the anti-Iranian regime ecosystem that Trump is wrapped into,” said Ali Vaez, director of the Iran Project at the Washington-based International Crisis Group.

One factor that could work in Iran’s favor is the changed geopolitical landscape facing Trump in the Middle East. During his first term, he was able to rely on support from Saudi Arabia and the United Arab Emirates, who both fully embraced his maximum-pressure strategy and tighter sanctions on Iran.

But the relationship between Riyadh and Tehran has improved significantly since then, with their mutual opposition to the civilian deathtoll of Israel’s wars against Iranian proxy groups in Gaza and Lebanon drawing them closer together. Both countries refreshed a bilateral agreement brokered by China at a meeting in the Saudi capital on Nov. 20.

For businessman Cyrus Razzaghi, there’s nothing new about the uncertainty. He’s advising clients that a fresh round of maximum pressure is likelier than a deal, but they should always keep an open mind.

“Back in 2016, there was a lot of wishful thinking in Tehran that this guy is a businessman, he could give us a really good deal. Soon the reality hit everybody,” Razzaghi said. “But one must be hopeful there’s still a chance for some kind of a deal because Iran has also learned from the past.”